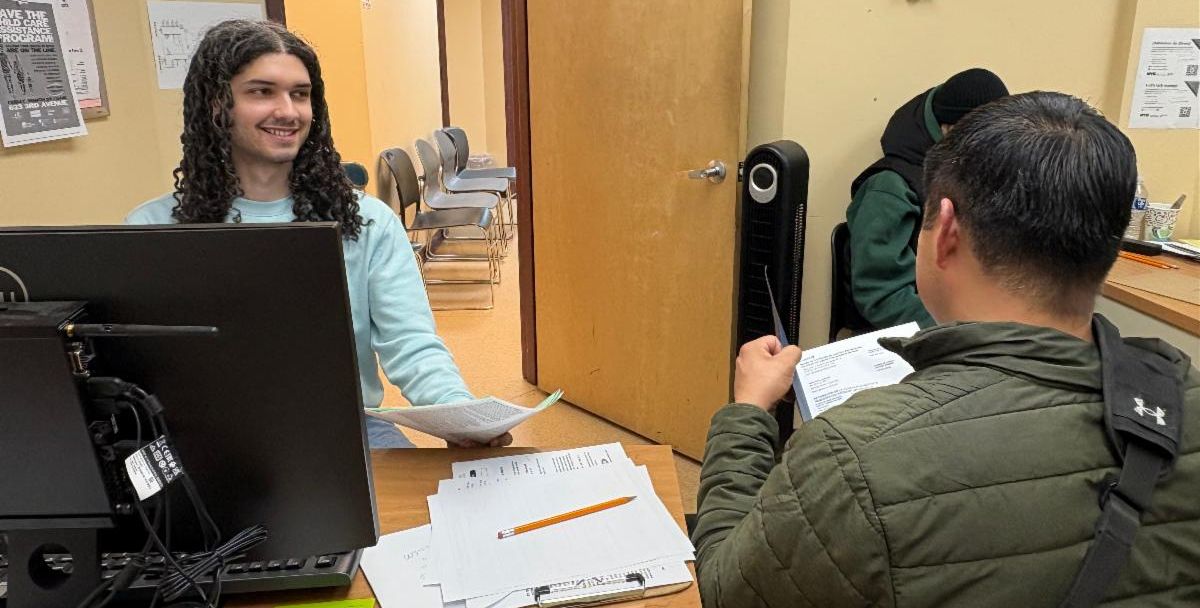

For over twenty years, Center for Family Life has been providing free tax-filing assistance to our neighbors in Sunset Park via the IRS’s Volunteer Income Tax Assistance (VITA) program, and our usually busy tax season hasn’t shown any signs of slowing!

As a VITA site, CFL has certified volunteer and staff tax preparers on hand to assist those who are eligible for VITA in filing their taxes.

Juan Obando, CFL’s VITA Tax Manager, conducts extensive outreach each year to recruit volunteer tax preparers. In addition to recruiting via NYC Service and NYC Department of Consumer and Worker Protection, Juan and his tax team have successfully secured partnerships with Fordham University, Kingsborough Community College, NY Cares, and Royal Business Bank to solicit volunteers. All volunteers receive thorough tax-preparation trainings and must acquire their official IRS Tax Certification before working as tax preparers.

This year, we’ve been lucky to have fifty-seven tax preparers support us in filing nearly three thousand returns, yielding over four million dollars in refunds! Thank you to all our CFL staff and volunteers who help make this program possible. The funds our neighbors receive in returns can be crucial for them to make rent, pay bills, or buy groceries.

Indeed, Juan has emphasized it is the ability to “help someone get the most money in a year, and hearing [our clients’] stories” which has been the most meaningful to him in his two decades of providing tax-free filing assistance professionally.

If you qualify for free tax preparation, we encourage you to make an appointment with us. More information on eligibility and appointments is outlined below.

Alternatively, if you have the means and are able to support our tax-filing assistance program, please consider donating to Center for Family Life today.

Interested in making an appointment?

In 2024, if your income was up to $65,000 as an individual — or up to $93,000 as a family — you are eligible for free tax filing services.

Appointments are available at CFL’s main office from 11am to 7pm on Mondays through Fridays, as well as on Saturdays from 9am to 4pm.

An appointment can also be made at our partner NYU Langone location — which is located on Fifth Avenue in Sunset Park — on Tuesdays through Thursdays between 12pm and 7pm.

Make an appointment with us today at either Center for Family Life’s main office or at our NYU Langone location.

Filing and Self-Employed?

If you work for yourself as a freelancer, gig worker, or small business owner, you need to file taxes annually and make estimated payments quarterly.

Our tax preparers through our Self-Employed Tax Program (SETP) are here to help; book an appointment with someone from our team today.