Our Cooperative Development Program (CDP) exemplifies how Center for Family Life’s innovative work cultivates community leadership.

In 2006, CDP launched out of community interest in the cooperative business model (where an organization is owned and managed by its worker-owners) and has since incubated twenty-six co-ops! The Center for Family Life team provides key resources and support to worker-owners throughout the cooperative’s life cycle.

Keep reading to hear some of the Cooperative Development Program’s recent highlights!

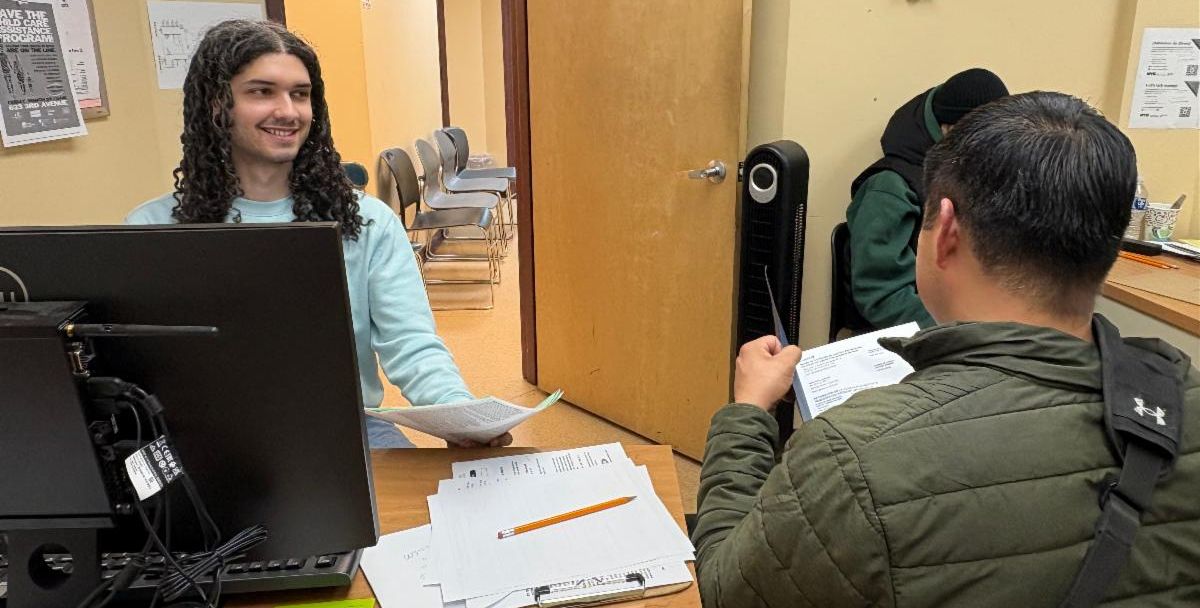

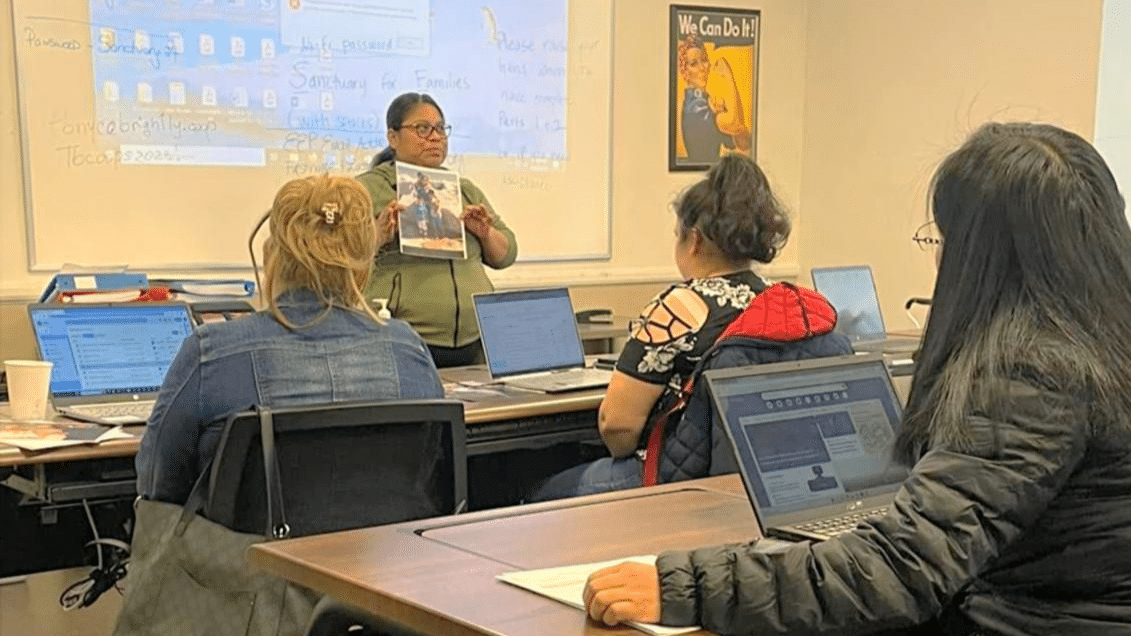

In collaboration with our Adult Employment Program, CDP launched their Small Business Workshops. Through a series of 6 workshops, community members learned how to navigate being a business-owner in NYC. This past year, over 70 community members benefited from these workshops!

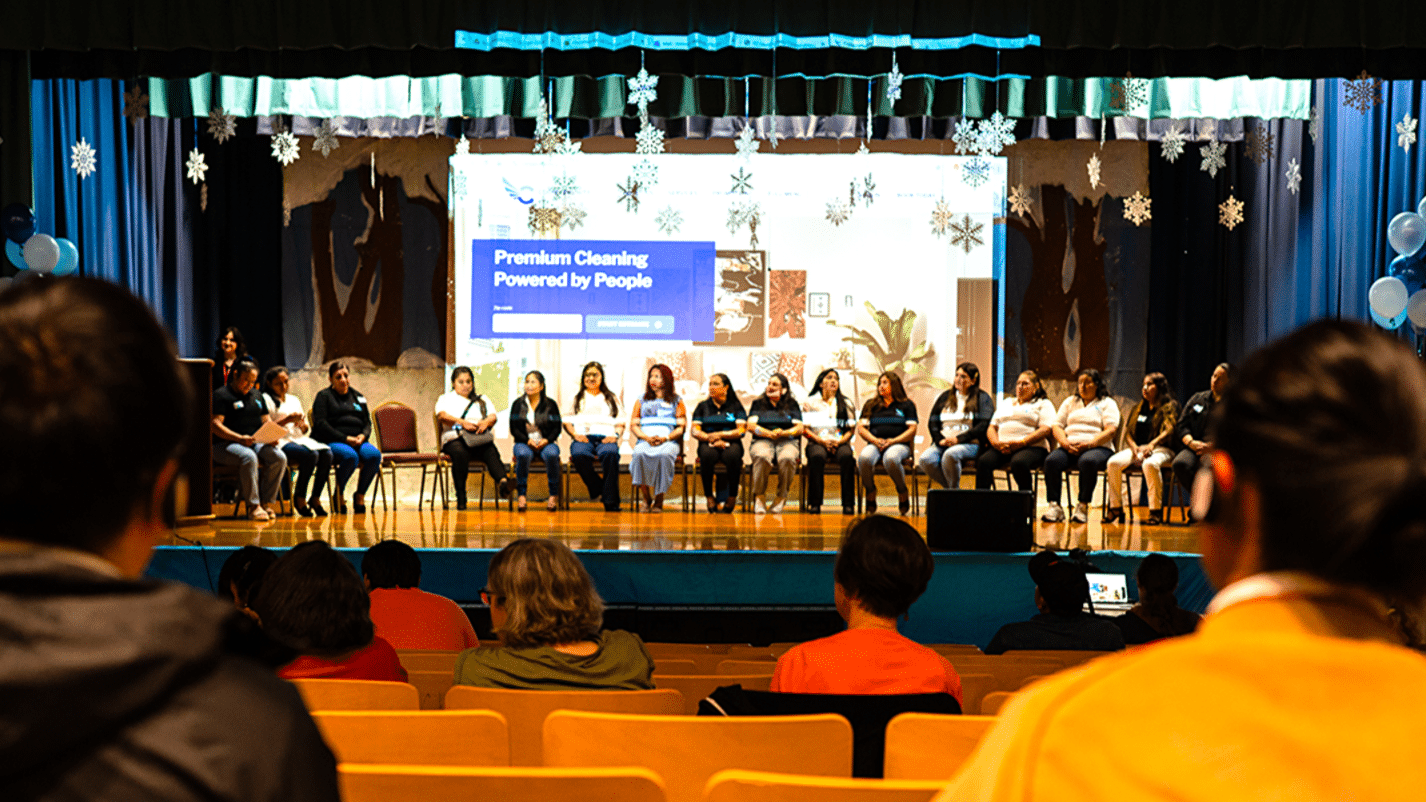

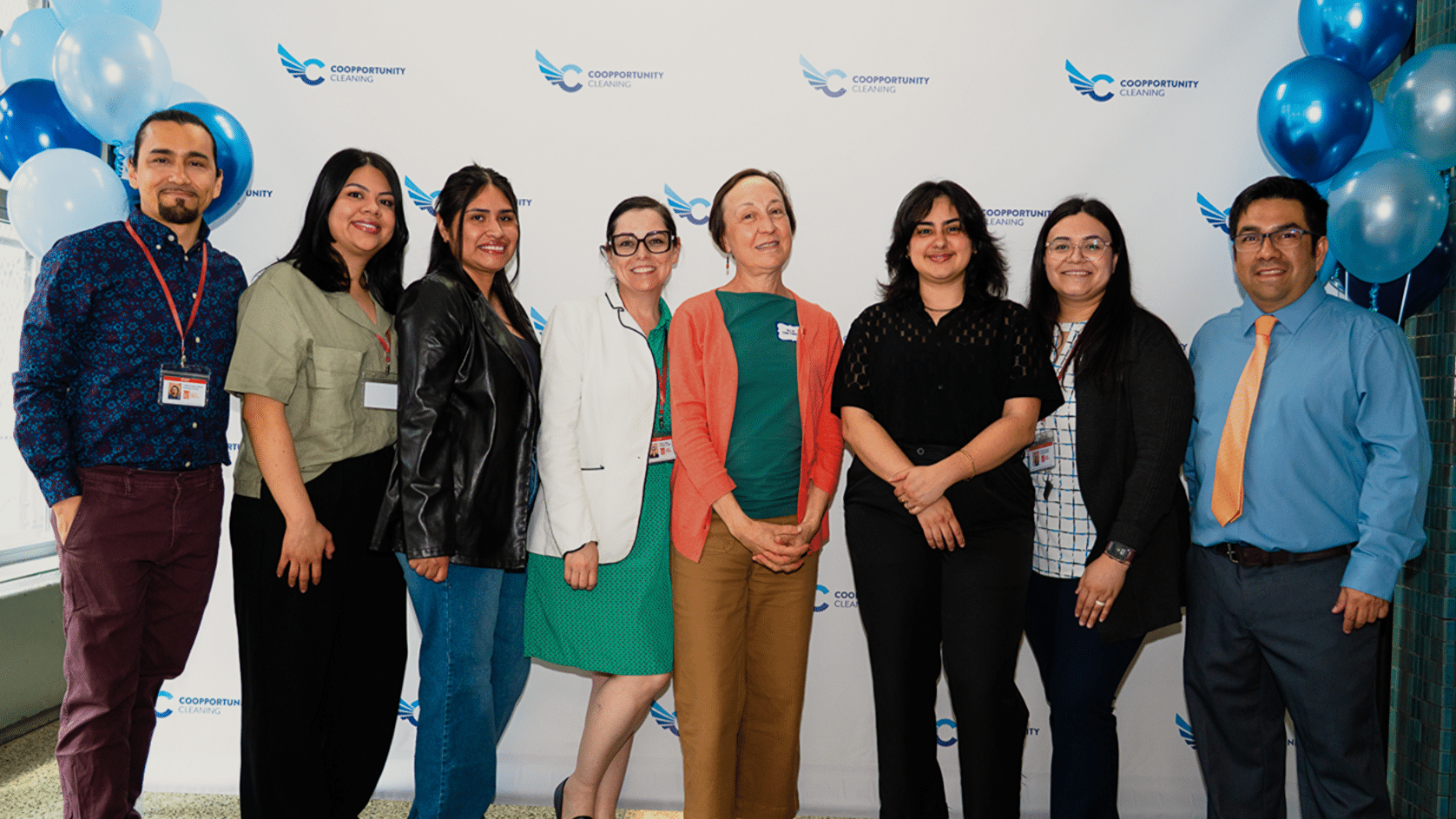

The latest cooperative to launch with the assistance of CDP is Cooportunity Cleaning! The organization is run by 32 worker-owners, and recently closed 2025 with $85,000 in income generated – this money went directly to the families of the beneficiaries.

Hear from Cooportunity Cleaning worker-owners:

“I have a voice in decisions, I am treated with dignity, and I know that our work supports the community. Every time I walk into a client’s home or office, I know I am building something bigger than myself.”

“Joining the cooperative changed everything. Now, I am part of a team where my voice counts, where respect is given, and where we share success together. Being an owner means I don’t just clean spaces – I help build a future for myself, my family, and my community.”

CDP also developed and launched the online sales software, SEED. This software helps small worker-owned cooperative businesses thrive in the increasingly competitive digital markets. Cooportunity Cleaning is the first business to use the SEED software in its daily operations.

Visit cooportunity.coop to learn more and support this local business.

Our Cooperative Development Program empowers individuals to gain control over their livelihoods and strive towards economic and social justice.

We are so proud to provide diverse services that contribute to a more equitable and sustainable global economy!